nys sales tax buffalo ny

You file an annual or quarterly sales tax return and. Brooklyn NY Sales Tax Rate.

New York Sales Tax For Photographers Bastian Accounting For Photographers

The DMV calculates and collects the sales tax and issues a sales tax receipt.

. Did South Dakota v. Order FAQ. The new york sales tax rate is currently.

Get Licening for my Erie County. Tax records include property tax assessments property appraisals and income tax records. You can Web File.

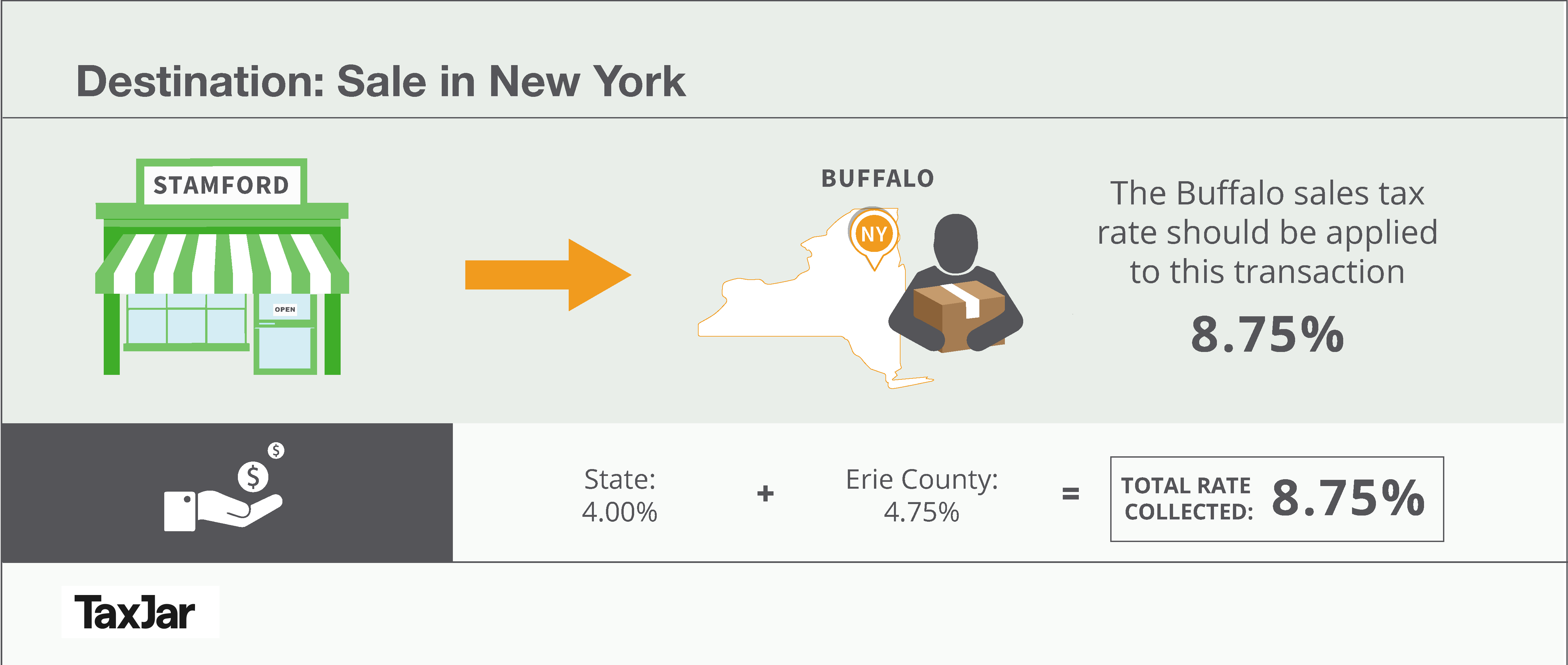

The County sales tax rate is 475. The New York sales tax rate is currently 4. Subscribe to Sales tax to receive emails as we issue guidance.

-- Counties in New York have until May 2 to cap sales tax on gasoline at either 4 3 or 2 per gallon in order for that relief to go into effect on June 1. Buffalo ny currently has 621 tax liens available as of february 4. If you leased the vehicle see register a leased vehicle.

Nys Sales Tax Buffalo Ny. Form ST-810 New York State and Local Quarterly Sales and Use Tax Return for Part-Quarterly Monthly Filers for PrompTax Filers Form FT-9451045 Report of Sales Tax Prepayment On Motor FuelDiesel Motor Fuel No-tax-due amended and final returns. New York will not collect portions of the states sales tax on sales of unleaded and diesel fuel for seven months beginning June 1.

Grocery Store LLC nys sales tax in Buffalo NY 5570214225nys sales tax Grocery Store. Order Tax ID for Grocery Store business in Buffalo NY Registration Requirements. This is the total of state county and city sales tax rates.

The New York sales tax rate is currently. The minimum combined 2022 sales tax rate for Buffalo New York is. 1 day agoALBANY With inflation-driven higher prices for goods pinching the wallets of consumers New Yorks county governments saw a notable increase in sales tax collections in the first quarter of.

New York State Association of Counties Deputy Director Mark LaVigne said seveal counties Nassau Suffolk Onondaga Oswego MonroeDutchess and Oneida have already. Get Licening for my Grocery Store tax id in 14225 Buffalo nys sales taxTax ID Registration Requirements for Grocery Store in Buffalo. Form ST-330 Sales Tax Record of Advance.

Sales and Use Tax Rates on Clothing and Footwear Publication 718-C - Effective March 1 2022. NYS Department of Taxation and Finance Buffalo Office Buffalo NY. 2022 Final Assessment Roll.

The County sales tax rate is. Review every sale of property in the City to keep up to date on annual sales values. Your combined total of taxable receipts purchases subject to tax rents and amusement charges is 300000 or more in a quarter or.

For information on the Oneida Nation Settlement Agreement see Oneida Nation. Sales tax rates. Get Licening for my Erie County.

The Buffalo sales tax rate is. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Order LLC for Grocery Store business in Buffalo NY Registration Requirements.

Sales tax applies to retail sales of certain tangible personal property and services. Order FAQ. The 875 sales tax rate in Buffalo consists of 400 New York state sales tax and 475 Erie County sales tax.

New york has 2158 special sales tax. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all property within the City of Buffalo. Grocery Store Tax ID Registration Requirements in Buffalo NY Grocery.

Wayfair Inc affect New York. If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. 7 rows The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475.

Use tax applies if you buy tangible personal property and services outside the state and use it within New York State. Grocery Store DBA nys sales tax in Buffalo NY 5570214225nys sales tax Grocery Store. What is the sales tax rate in Buffalo New York.

Buffalo NY Sales Tax Rate. Withholding tax filers Quarterly withholding tax returns Forms NYS-45 and NYS-45-ATT are due Monday May 2 2022. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD.

Order DBA for NY business in Buffalo NY Formation and Set Up. Groceries are exempt from the erie county and new york state sales taxes The new york state sales tax rate is 4 and the average ny sales tax after local surtaxes is 848. Monthly quarterly and annual sales tax returns.

Choose the online service you need from Employment and withholding. You file part-quarterly Monthly if. Select the Services menu from the upper-left corner of your Account Summary homepage.

NY Connects is your trusted place to go for free unbiased information about long term services and supports in New York State for people of all ages or with any type of disability. This is the total of state county and city sales tax rates. Nys department of taxation and finance buffalo office provider address.

You owe 3000 or less in tax during an annual filing period. There is no applicable city tax or special tax.

New York Sales Tax Guide And Calculator 2022 Taxjar

Sales Use Tax Hodgson Russ Llp

New York Vehicle Sales Tax Fees Calculator

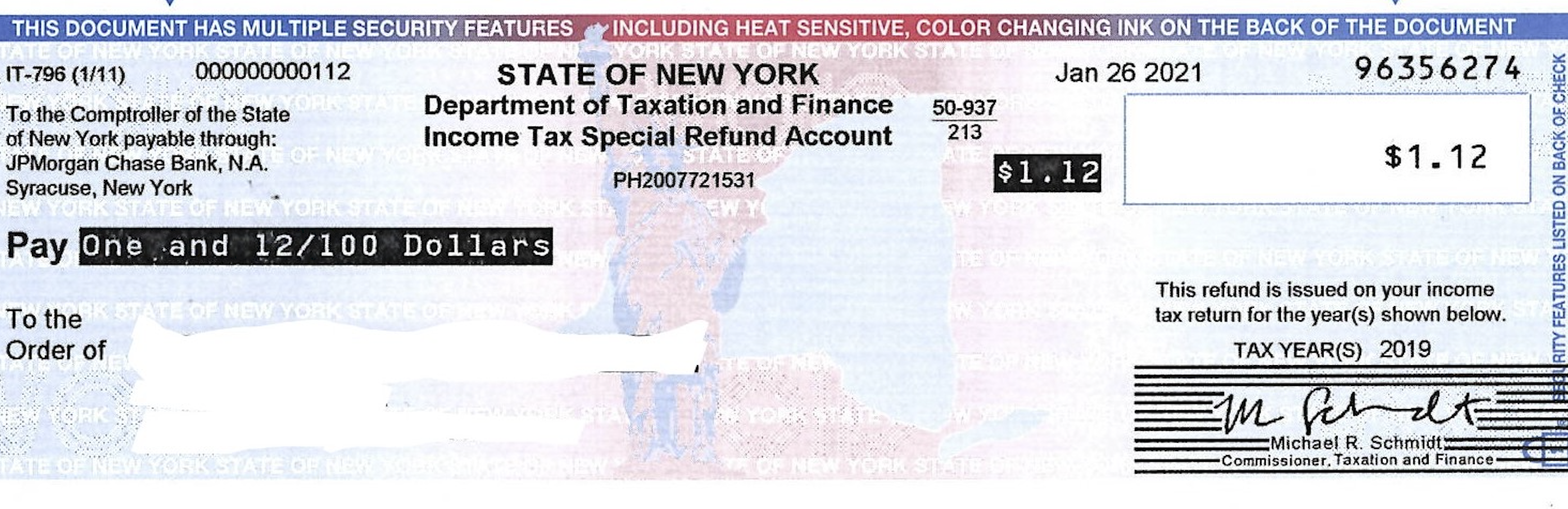

Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com

New York State Department Of Taxation And Finance Ppt Video Online Download

New York Vehicle Sales Tax Fees Calculator

New York Tax Rates Going Up With A Twist Hodgson Russ Noonan S Notes Blog

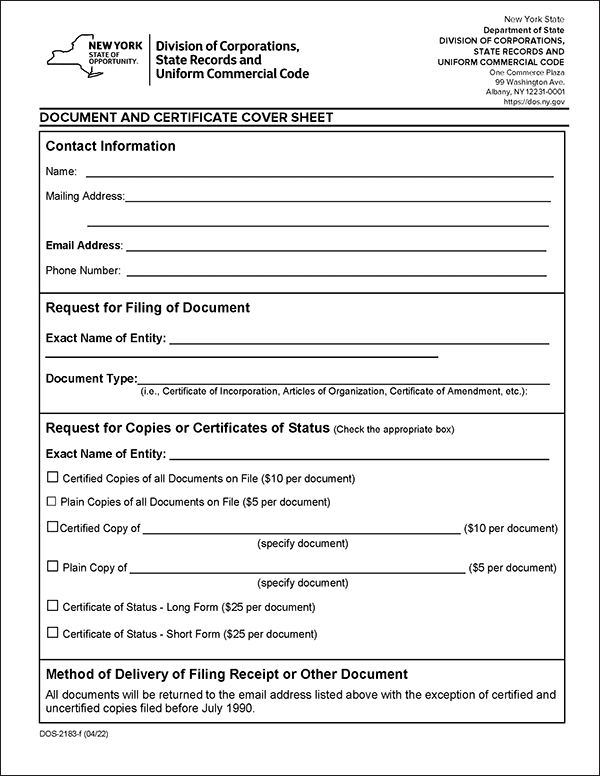

Llc New York How To Start An Llc In New York Truic

Welcome To Empire State Development

New York Sales Tax Rates By City County 2022

Buffalo Ny Cost Of Living Guide 2020 Is Buffalo Affordable Wayfinder Moving Services

Life In Buffalo 10 Things To Know Before Moving To Buffalo Ny

Is Saas Taxable In New York Taxjar

Llc New York How To Start An Llc In New York Truic

New York Sales Tax For Photographers Bastian Accounting For Photographers

How To Charge Your Customers The Correct Sales Tax Rates

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

New York Sales Tax For Photographers Bastian Accounting For Photographers